Manufacturing accounting software manages all of the financial transactions and operations for manufacturers. Generic programs, such as manufacturing software for Quickbooks, don’t have the unique capabilities that manufacturers require. The diagram notes how the $500,000 of depreciation cost flows to the balance sheet and income statement components. Be aware that the illustration only shows dollar amounts related to depreciation; clearly there would be many other costs to consider. Small-business owners have many options when choosing a manufacturing accounting system.

As a manufacturing business, you understand the crucial link between a seamless production line and achieving lasting success. The efficient flow of operations, from raw materials to finished products, is vital to meet customer demands and maintain a competitive edge in the industry. The job order costing method calculates costs per manufacturing project or unit, making it useful for make-to-order manufacturers, construction manufacturers, and the like. Production costing methods organize your cost accounting records to help management make decisions. Depending on your business model, you may prefer to structure your accounting around individual units, product lines, or processes.

Manufacturing Accounts

In this guide we’ll walk you through the financial statements every small business owner should understand and explain the accounting formulas you should know. Direct labor is the value given to the labor that produces your goods, such as machine or assembly line operators. Generally, this includes the cost of the regular hours, overtime, and relevant payroll taxes.

Overhead costs include expenses like factory rent, utilities, and administrative costs. Process costing involves tracking the cost of each stage of production. It helps facilitate analysis and efficiency refinement for businesses that revolve less around each unit and more around repetitive procedures. The first-in-first-out (FIFO) inventory valuation method assumes that the first unit you manufacture is the first one you sell.

Choose the right accounting method

If all your money is tied up in assets and immovable stock, you may be unable to make an important payment. Where possible, you should make payments over longer periods of time, to ensure money is always in the bank. If you maintain optimal levels of stock, you’ll have less wasted goods and lower storage costs. You should be sure to hire talented and capable individuals for your finance team, people that will add real value to your accounting processes. Not only this, but you should maintain an environment of continuous learning, and provide the relevant tools / training for each employee to excel in their role. Every business unit you define must have an object and, optionally, subsidiary accounts.

Textile Manufacturing Market Fabric Production Dynamics 2023 to … – Digital Journal

Textile Manufacturing Market Fabric Production Dynamics 2023 to ….

Posted: Mon, 21 Aug 2023 12:16:55 GMT [source]

By switching things around and making the cost of goods sold the subject, we can get another formula. Finished goods are inventories that have been fully manufactured and are ready for sale. The software should also enable users to create and customise their reports with ease along with a function to remember last report edits so users can easily duplicate for future usages. By closely keeping tabs of all asset life cycles, manufacturers will be able to identify wasteful purchases and invest more on pieces of equipment that are truly beneficial for the workers. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Activity-based costing

This will help to identify opportunities to improve efficiencies companywide, drive revenue and increase profit. Employing job costing enables businesses to assign costs to each production run or batch of products, facilitating a comprehensive tracking of expenditures specific to each job. The resulting data can then be leveraged to make informed pricing decisions, optimize production processes, and allocate resources effectively. On your typical manufacturing balance sheet, you should have raw materials, work in process, and finished goods as part of your inventory calculation. You will also want a periodic or perpetual inventory system to track how many products you have in your production line at any one time.

While the shop floor needs a network, it does not necessarily need to have servers. With the server in the cloud, the facility does not have to have staff to maintain it or back it up. It is crucial to select accounting software that seamlessly integrates with other essential programs, such as inventory management, production scheduling, and invoice generation. Compatibility with existing management tools and databases minimizes the risk of data loss or disruption to ongoing processes. Integration streamlines operations, automates tasks, and enhances overall efficiency.

Inventory management

In a manufacturing business, there are some important terms you need to understand when it comes to calculating the costs of manufacturing your product, as well as the amount of inventory you hold. This provides valuable feedback on your manufacturing and inventory processes. In manufacturing, fixed costs remain consistent no matter how many units you produce. For example, that might include rent for your factory or interest payments on a business loan.

Average costing is useful in situations where it is difficult to assign costs to specific or individual products. If you want to refine your production process and automate aspects of your business, accurate costing information helps you identify wasteful costs passed on to the customer or absorbed within the company. This is all in aid of increasing your revenue and your profit margins. The weighted average is generally the least common cost flow assumption for manufacturers. In fact, the IRS previously dismissed this method as inaccurate, only allowing businesses to use it for tax purposes in 2008. These are the inventory tracking methods they accept for manufacturing businesses.

- This is typically achieved by implementing a double-entry system, which diligently tracks all financial transactions and safeguards against errors or discrepancies.

- This account tracks all of the raw materials or physical items necessary to create a product.

- Companies only incur the cost of goods sold when they sell inventory.

- Variances occur when the frozen standard costs differ from other user defined cost methods, such as current costs.

Manufacturing accounts can help businesses track their production costs, materials used, and inventory levels. Manufacturing accounts can also help businesses budget for future production costs. Features found in accounting software such as inventory management can help you optimize the way you use inventory, such as providing alerts when your stock needs replenishing. It is crucial when understanding raw materials, work-in-process, and finished goods. It will avoid a situation where you have too much inventory (which costs money) or, even worse, not enough inventory, where you cannot fulfill the requirements of your customers. If job costing is ideal for manufacturing businesses that produce lower numbers of unique products, process costing is for those that create a high volume of homogenous units.

FIFO is generally the most popular approach, especially for manufacturers of products with limited shelf lives. In some cases, you will need to further classified office expenses into “administrative” and “selling and distribution expenses”. Unlike trading businesses, manufacturing businesses do not buy products at a low price and sell at a higher price. Many accounting solutions have built-in Business Intelligence (BI) capabilities, which helps Manufacturing accounting users to further enhance their analytical ability. BI is a powerful tool that empowers users to drastically increase efficiency by equipping them with real-time insights, data that are otherwise impossible to extract on time if using normal spreadsheets. If your firm decided to choose a stand-alone accounting solution, make sure that you select one that has capabilities to integrate well with other systems your plant currently housing.

Most systems are offered in a suite of modules that include customer relationship management (CRM), material requirements planning (MRP) and manufacturing execution software (MES). This complete suite of modules is often referred to as an enterprise resource planning (ERP) system and can manage the entire operations of an enterprise. Assume you own a bicycle store and purchase bicycles and accessories to sell to customers.

Operational Costing Vs. Process Costing Systems

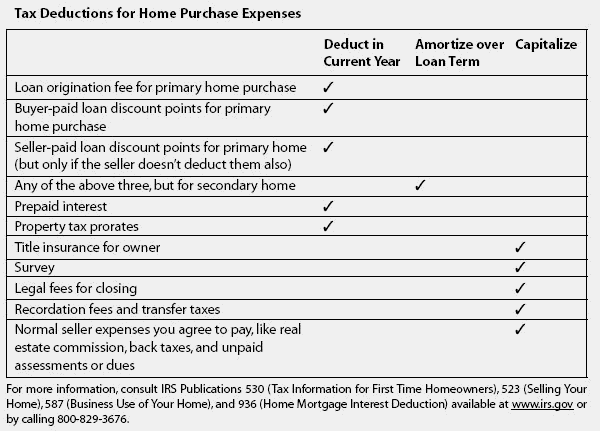

As a result, it’s worth investing in developing a deeper understanding of the related accounting and tax rules. If nothing else, it’ll help you analyze your financial statements and reports to improve the efficiency of your business. While you probably won’t handle all your business’s accounting personally, you still need to understand it.

The difference between the planned and actual material costs, based on the work order parts list. The difference between the planned and actual labor costs, based on the work order routing. You can group and report transactions posted to a general ledger account with subledger types. You can also report on subledgers across accounts (for example, all accounting activity by asset ID or by work order number). In the general ledger, “debit” and “credit” refer only to the position of the columns on the account.

The total manufacturing cost also informs two crucial KPIs for determining a company’s Gross Profit and Gross Margin – Cost of Goods Manufactured (COGM) and Cost of Goods Sold (COGS). If you can’t keep track of every item in your inventory because the units are interchangeable, you must assume which ones you sell first. While you can’t know for sure which you sell first, this keeps your books organized. The specific identification method is the most straightforward option. If that’s feasible for your business, the Internal Revenue Service (IRS) requires you to use this method. 4) Factory overhead – Costs which occur in the factory where the production is being done.

Some solutions also include project management, time tracking and payroll tools for higher-tier accounts or offer as add-ons based on specific business needs. Perhaps the most important accounting difference between merchandisers and manufacturers relates to the differences in the nature of their activities. On the other hand, a manufacturer must purchase raw materials and use production equipment and employee labor to transform the raw materials into finished products. Inventory valuation, direct labor and manufacturing overhead costs are just part of the recipe that is cost accounting in the manufacturing industry.