Content

It is https://casinolead.ca/300-welcome-bonus-casino/ also possible to claim both bonus depreciation and Section 179 deductions in the same tax year. Or after September 27, 2017, and before January 1, 2024, for certain properties with longer production periods. Or after September 27, 2017, and before January 1, 2024, for certain properties with longer production periods.NCNo. Kentucky does not conform to the Tax Cuts and Jobs Act provision that provides a 100percent first-year deduction for the adjusted basis allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023.

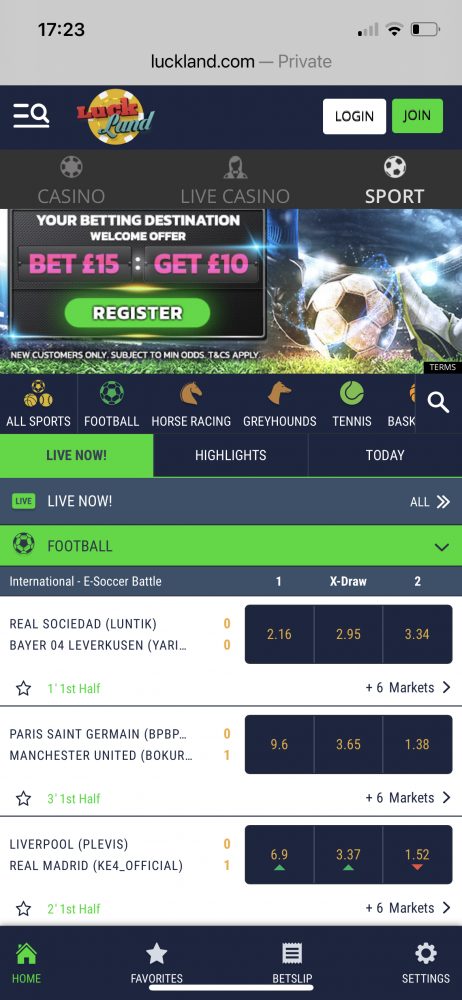

- Online casinos also give a free bonus no deposit to to their existing players, most commonly to reward them for their loyalty or give them an incentive to start playing again.

- It’s no secret that no deposit bonuses are mainly for new players.

- Stay connected with the latest travel, aviation, and credit card news.

A no deposit casino is an online casino where you can use a free bonus to win real money – without spending any of your own. You can find the best US no deposit casinos and bonuses here on this page. While many casinos offer no deposit bonuses to new players as part of their welcome package, existing players can also receive these bonuses through ongoing promotions, loyalty rewards, or exclusive offers. You can take full advantage of Section 179 and bonus depreciation if you purchased qualifying property for your business any time during the tax year. Unlike with regular depreciation, you need not reduce your deduction if you purchased property late in the year. In addition, if the asset is listed property, it must be used more than 50percent of the time for business to qualify for bonus depreciation.

What Is The Difference Between Bonus Depreciation And Section 179?

Casino.org is the world’s leading independent online gaming authority, providing trusted online casino news, guides, reviews and information since 1995. Playing at minimum deposit casinos allows your bankroll to last for longer. – The size or value of the bonus is obviously an important factor, as players naturally want to get as much free bonus funds or as many free spins as possible. According to our testers and feedback from other players that claimed this bonus, the process of getting this bonus is more or less instant. Be the first one to report the availability of this bonus to other players.

Economic, Revenue, And Distributional Impact Of Permanent 100 Percent Bonus Depreciation

Therefore, it’s possible to reduce your company’s taxable income to zero using Section 179 and then use bonus depreciation on any depreciable assets to create a tax loss that can be carried forward to a future tax year. If both entities elect the maximum Section 179 deduction in 2023, then they will each pass down 1,160,000 of Section 179 depreciation deductions to the shareholder’s individual federal income tax return. If your company is planning on investing in manufacturing equipment or other eligible property in the next few years, you might be able to reduce your tax liability by moving the timeline up and accelerating purchases while bonus depreciation still exists. Covering the period from 1997 through 2011, they found firms respond to bonus depreciation by increasing their capital stock and employment.

Calculate Bonus Depreciation

If you don’t use them in this timeframe, your free spins will be removed from your account. These games look very similar to original slots and casino games but are not original. Fake games can have altered mathematical setup, such as a lower RTP. Casinos with a High Safety Index usually have a large number of visitors and a small number of unresolved complaints. Players can expect to play safely and be treated well in casinos with a High Safety Index. IHG One Rewards points purchases are processed by points.com, meaning they don’t count as a hotel purchase for the purposes of credit card spending.

The Act retained the current Modified Accelerated Cost Recovery System recovery periods of 39 and 27.5 years for nonresidential and residential rental property, respectively. However, the ADS recovery period for residential rental property was reduced to 30 years from 40 years effective for property placed in service on or after Jan. 1, 2018. Bonus depreciation is only applicable to certain business assets that meet qualification requirements. Property must have a maximum useful life of 20 years, and it can be used for either business or personal use.

A Small Business Guide To Bonus Depreciation

After-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. Receipts, the cost of the policy falls to 296 billion over the 10-year window. The cost would fall outside the budget window, as can be seen in the declining revenue pattern toward the end of the budget window. Payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance.

No Deposit Free Spins

The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state.