In this article

- USDA Outlying Creativity Loans, Area 9: USDA Finance against. FHA Funds

- Debtor Eligibility

- Credit history

- Advance payment

- Financial Insurance coverage (PMI)

- Loan Constraints

- Home loan Items

- Possessions Brands

Purchasing your first domestic or condo is actually a very fascinating sense. Homeownership ‘s the foundation of the latest American Dream in addition to basic action towards the economic versatility. You’ll have a property you could potentially truly telephone call the. After that, in addition gain of most of the monetary masters like assets like (household equity) and you will sophisticated income tax vacations.

Among home loan software that most earliest-big date homeowners is to studies are the fresh USDA Rural Advancement Financing. In this ongoing web log series, we’ve been investigating all you need to know about it mortgage system given by the us Department from Agriculture. This type of money offer up to 100% money (zero down-payment requisite), low-interest rates minimizing mortgage insurance rates (PMI) costs. Listed here are helpful backlinks to the other stuff in this series at this point:

Additional mortgage program you must know on the ‘s the FHA mortgage, given by the brand new Federal Property Management. Each other USDA and you can FHA funds are perfect for earliest-big date homebuyers. Today, you want to walk you through the differences, as well as the benefits and drawbacks of each financing type of. USDA Outlying Invention Financing are also chatted about.

Borrower Eligibility

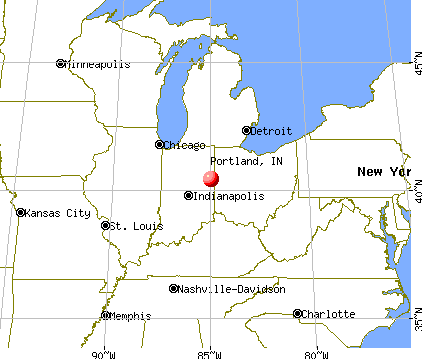

The biggest difference in FHA and you will USDA financing is certain debtor qualification conditions. USDA financing was designated to own rural components as defined from the USDA and the current census analysis. They have to be in urban centers with all the way down communities much less availability in order to financial borrowing. The buyer also needs to keeps a reduced-to-reasonable money (prior to the latest median money of city) to help you meet the requirements. Read Area dos for more information about this. An FHA mortgage does not have any earnings constraints otherwise venue constraints.

Credit rating

Extremely USDA Rural Advancement Money will require a credit rating out of 640 or more, if you find yourself FHA consumers can have credit ratings as little as 580 provided other economic indicators come in reasonably good shape.

Advance payment

USDA funds provide 100% money. It means zero downpayment is needed. There is going to still be particular initial closing costs (look for Area eight), however the borrower has no to put anything off on the the main worth of the loan mortgage. FHA loans generally wanted a great step 3.5% down payment to help you be considered. Virtual assistant funds also offer 100% investment but are limited so you’re able to military experts, active services players, and you may thriving partners. For individuals who fall under one classes, you will definitely be interested in a Virtual assistant mortgage.

Mortgage Insurance policies (PMI)

People home mortgage for which you set less than 20% down will demand you to shell out personal mortgage insurance rates (PMI) if you do not have reached no less than the new 20% full dominating commission threshold. These are non-refundable money added on your month-to-month mortgage costs. FHA money typically require an upfront mortgage insurance policies commission of just one.75% of one’s amount borrowed, immediately after which yearly superior of 0.85% (divided in to several monthly obligations). USDA Rural Development Financing supply the lower PMI pricing of every mortgage loan. Its essentially a-1% initial fee and you can 0.35% yearly rates (split up into 12 monthly obligations.

Mortgage Restrictions

USDA funds don’t have one restrict financing limits. Fda financing will receive a max loan amount of $356,362 for the majority components. That it amount is updated yearly and certainly will start around county to say and you will state so you’re able to condition according to median home values https://paydayloanalabama.com/powell/ in the area.

Home loan Types

USDA fund are just readily available for 30-year fixed-speed mortgages. FHA funds provide a lot more freedom for use for 29-12 months fixed-rate mortgages, 15-season fixed-rate mortgage loans, and you can adjustable-rate mortgage loans (ARMs).

Property Types

USDA Rural Advancement Fund can simply be taken getting single-nearest and dearest top houses in outlying section. They can’t be reproduced toward the purchase out of an investment property or next house. At the same time, Food and drug administration loans must also be taken to own priily functions which have right up in order to four devices so long as you consume one of the tools.

They are number 1 differences when considering USDA home loans and you can FHA lenders. If you think youre eligible for one or all of this type of apps (and/or a Virtual assistant financing, also), it is preferable to speak along with your home loan company. Mention your house loan choice and choose the application that is perfect for your financial situation.

To go over your real estate loan choices for Atlanta first-big date homebuyers, contact Moreira Class | MortgageRight now. We will help you to get our home mortgage that is right to you personally as well as your family unit members.